Box trucks, with their versatile but high-risk operations, require specialized insurance for box trucks to protect against damage, theft, weather conditions, and accidents due to their open design and size. Comprehensive coverage options include liability, collision, cargo insurance, and environmental liability. The right policy provides peace of mind and financial protection for these vehicles carrying valuable cargo and equipment. Box truck drivers should also adopt defensive driving techniques, maintain regular vehicle checks, and prioritize safety to enhance road safety.

In today’s fast-paced logistics landscape, box truck operations present unique risks on the road. From cargo damage to driver safety, ensuring full protection is paramount for businesses relying on these versatile vehicles. This article guides you through the intricacies of insurance for box trucks, covering understanding specific risks, exploring various coverage types, selecting the right policy, and essential safety tips for drivers. By the end, you’ll be equipped with knowledge to safeguard your investment and navigate the road ahead with confidence.

- Understanding the Unique Risks of Box Truck Operations

- Types of Insurance Coverage for Box Trucks

- Protecting Your Investment: Choosing the Right Policy

- Staying Safe on the Road: Tips for Box Truck Drivers

Understanding the Unique Risks of Box Truck Operations

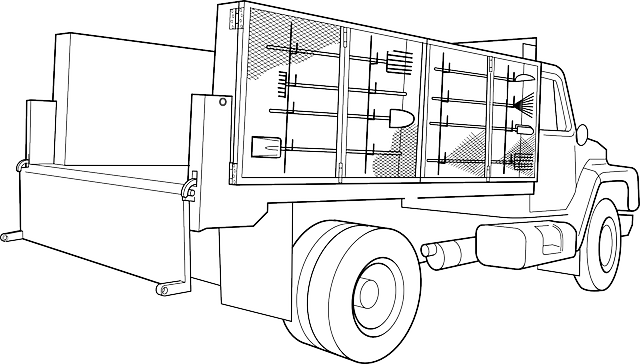

Box trucks, with their distinctive design and diverse uses, come with unique operational risks that necessitate specialized insurance coverage. Unlike standard vehicles, these trucks often carry delicate cargo, ranging from fragile goods to valuable equipment, requiring extra protection against potential damages or theft during transit. The open nature of the box also makes it vulnerable to weather conditions, accidental damage, and even vandalism.

Moreover, box truck operations are not without their safety challenges. Due to their size and weight, these vehicles demand careful handling, especially in congested urban areas or narrow roads. Skilled drivers are essential to mitigate risks associated with loading/unloading procedures and the potential for rollovers, which can lead to significant financial losses and legal liabilities. Therefore, comprehensive insurance for box trucks is not just an option but a necessity to safeguard against these myriad of risks.

Types of Insurance Coverage for Box Trucks

When it comes to protecting your investment in a box truck, having comprehensive insurance is paramount. Insurance for box trucks typically includes several key coverage options designed to shield against various risks inherent in transporting goods. First and foremost, insurance for box trucks should encompass liability coverage, which protects against damages caused to other vehicles or properties during an accident, as well as any legal costs that may arise.

In addition to liability protection, specific types of insurance for box trucks may include collision coverage, which pays for repairs or replacement in the event of a crash, regardless of fault. Cargo insurance is also crucial, safeguarding your merchandise from loss, damage, or theft while it’s in transit. Many policies further offer environmental liability coverage, protecting against costs associated with cleaning up any spills or leaks that might occur during transport.

Protecting Your Investment: Choosing the Right Policy

Protecting your investment is paramount when owning a box truck, as these versatile vehicles often carry valuable cargo and equipment. The right insurance policy can provide peace of mind, ensuring that unexpected events don’t put your financial well-being at risk. When considering insurance for box trucks, assess your specific needs and the potential risks involved in your line of work.

Choosing a comprehensive policy tailored to box truck owners offers several benefits. It typically includes coverage for liability, collision, and damage to your vehicle, as well as protection for valuable cargo and equipment inside. This ensures that if your truck is damaged or stolen, or if someone is injured while using it, you’re financially secured. Research different providers and policies to find the best fit, considering factors like deductible amounts, coverage limits, and additional perks tailored to box truck owners.

Staying Safe on the Road: Tips for Box Truck Drivers

Staying safe on the road is paramount for box truck drivers, who often face unique challenges due to their larger vehicles and specialized cargo. A comprehensive insurance policy tailored for box trucks is a solid first step. These policies typically cover liability, collision, and comprehensive damages, ensuring financial protection in case of accidents or theft. Beyond insurance, drivers should prioritize defensive driving techniques, staying alert, and regularly maintaining their vehicles to mitigate risks.

Regular breaks during long hauls are essential to combat fatigue, which can significantly impact reaction times. Maintaining a safe following distance from other vehicles and adhering to speed limits are additional strategies. Additionally, keeping the truck’s cargo securely fastened and using reflective tape for visibility during low-light conditions can prevent accidents and protect the cargo.

In light of the unique risks associated with box truck operations, ensuring comprehensive protection is paramount. By understanding these risks and exploring the various insurance coverage options available, such as liability, collision, and cargo insurance, owners can make informed decisions. Choosing the right policy tailored to their fleet’s specific needs becomes a crucial step in protecting investments and safeguarding against potential losses. For drivers, adhering to safety guidelines and staying vigilant on the road is essential, ultimately contributing to a safer and more secure environment for everyone. Remember that investing in adequate insurance for box trucks is not just about compliance; it’s a vital strategy to navigate the challenges of trucking with confidence.