Custom box truck insurance is specialized coverage for businesses using vehicles with unique features like temperature control or custom interiors. Unlike standard commercial auto policies, it protects both the truck and its box body, addressing specific risks associated with these vehicles. Rates are influenced by factors such as goods transported, vehicle specifics, driving record, maintenance history, delivery frequency, and chosen coverage type with deductibles. Food delivery services, facing challenges in food safety, property damage, and personal injuries, greatly benefit from this insurance to protect against legal claims, reputational damage, and financial risks. Choosing the right insurer is crucial for financial security and operational continuity, focusing on comprehensive liability protection and cargo coverage, insurer reputation, reviews, and comparing quotes.

In today’s competitive delivery landscape, ensuring comprehensive protection is paramount. This article provides an in-depth guide to navigating the intricacies of custom box truck insurance, a vital component for businesses prioritizing safety and risk mitigation. We’ll explore what this specialized coverage entails, delving into its benefits and how it protects against potential liabilities. From understanding rate influencers to recognizing common claims, this resource equips delivery service operators with knowledge to make informed decisions regarding their custom box truck insurance needs.

- Understanding Custom Box Truck Insurance: What It Covers and Why It Matters

- Factors Influencing Your Delivery Service Insurance Rates

- Types of Risks and Claims Commonly Associated with Food Delivery Services

- How to Choose the Right Insurer for Your Delivery Business: Tips and Best Practices

Understanding Custom Box Truck Insurance: What It Covers and Why It Matters

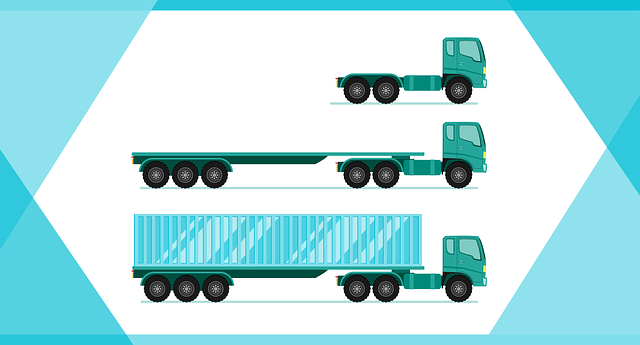

Custom box truck insurance is a specialized coverage designed for businesses that rely on trucks equipped with custom-built box bodies. This type of insurance goes beyond standard commercial auto policies, addressing unique risks associated with these specialized vehicles. It covers not just the physical truck but also the tailored box itself, which may have features like temperature control, specific loading mechanisms, or customized interior layouts.

The importance of this insurance lies in its ability to protect against potential liabilities. If your custom box truck is involved in an accident or suffers damage, this specialized coverage ensures that repairs or replacements can be made to the unique components of the box body. It also provides legal protection if there are claims related to cargo carried in the customized compartment, ensuring your business remains shielded from financial losses and legal issues.

Factors Influencing Your Delivery Service Insurance Rates

Several factors play a significant role in determining your delivery service insurance rates, especially when utilizing custom box trucks. One key aspect is the nature and value of the goods being transported. Different types of cargo require distinct levels of protection, with high-value items necessitating more comprehensive coverage to mitigate potential losses. The physical characteristics of your truck are another crucial consideration; larger or specialized vehicles may incur higher insurance costs due to increased liability and repair expenses.

Additionally, your delivery service’s risk profile is a critical factor. This includes factors like driving record, vehicle maintenance history, and the frequency and distance of deliveries. Safe driving practices and well-maintained vehicles generally lead to lower insurance rates. Furthermore, the type of coverage you choose—liability, collision, or comprehensive—and the deductibles you select will significantly impact your premiums. Custom box truck insurance rates are tailored to these variables, ensuring that delivery services have adequate protection for their unique operational needs.

Types of Risks and Claims Commonly Associated with Food Delivery Services

Food delivery services, while convenient for customers, come with their own set of risks and challenges. One of the primary concerns is food safety and quality, which can lead to various claims, especially if there’s a breach in sanitation or temperature control during transit. For instance, foodborne illnesses caused by contaminated deliveries can result in legal liabilities and damage to the delivery service’s reputation.

Another common risk is property damage related to accidents involving delivery vehicles, such as crashes or incidents of theft. Custom box truck insurance plays a crucial role here, offering protection for both the vehicle and its contents against these potential hazards. Additionally, claims may arise from personal injuries suffered by customers during the delivery process, requiring comprehensive liability coverage to mitigate financial risks.

How to Choose the Right Insurer for Your Delivery Business: Tips and Best Practices

Choosing the right insurer for your delivery business is crucial as it directly impacts your financial security and operational continuity. The first step is to understand your specific needs, particularly when it comes to custom box truck insurance. Since delivery services often deal with valuable goods, specialized packaging, and varied routes, a tailored insurance policy is essential. Look for insurers who offer comprehensive coverage that includes liability protection against property damage or personal injury during transit, as well as cargo coverage to safeguard your goods from theft or damage.

Next, consider the insurer’s reputation and financial stability to ensure they can fulfill their obligations in case of a claim. Check reviews and industry rankings to gauge their reliability. Additionally, request quotes and compare policies from multiple providers to find the best balance between cost and coverage. Remember, while the cheapest option may seem appealing, inadequate coverage could leave you vulnerable in the event of an accident or loss. Ensure your policy includes specific endorsements for any unique aspects of your delivery operation, such as custom box trucks, to guarantee comprehensive protection.

Comprehensive coverage for delivery services, particularly tailored through custom box truck insurance, is not just a legal necessity but an investment in your business’s resilience. By understanding what this insurance covers and managing influencing factors, you can mitigate risks effectively. Food delivery services face specific challenges, from liability to property damage claims. Choosing the right insurer involves evaluating policy options, comparing rates, and considering specialist knowledge of the delivery industry. With the right custom box truck insurance, your delivery business can navigate risks with confidence, ensuring a secure and prosperous future.